This blog is a part of our series, “Perspectives in Crime” where we explore leading academic studies that touch on crime data.

Automated Teller Machines (ATMs) provide a convenient, low-contact way for bank customers to conduct transactions. Across the world, there are over 5 million ATMs: approximately 400,000 ATMs in the United States; 50,000 ATMs in the UK; 70,000 in Canada; and 30,000 in Australia. Despite their convenience, ATMs expose bank customers to a heightened risk of victimization and create a new dimension of risk to be considered by financial institutions.

What are common threats to ATM security?

Three common types of crime involving ATMs involve 1) physical attacks on machines, 2) card skimming devices added onto machines to steal customer information, and 3) robberies at or near machines.

UK Police recently arrested 22 people in connection with a string of over 40 attacks on ATMs across England, Wales, and Scotland since the spring of 2021. These attacks stole large quantities of cash and caused physical damage and business closures at affected buildings, including post offices, gas stations, and convenience stores.

Amidst ongoing problems with credit card skimming fraud, the Australian Payments Clearing Association stated that skimming fraud at ATMs in Australia cost over $2.3 million.

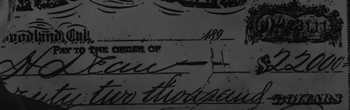

Since the turn of the century, the FBI’s official bank crime statistics show a steep decline in robberies within banks. These changes had driven an overall reduction in bank crimes. Figure 1 shows official FBI statistics for Bank Robberies at the Counter since 2003.

But 2020 and 2021 statistical analysis shows a sharp increase in crime incidents at ATMs. ATM crimes in America increased 600% from 2019 to 2020. Figure 2 shows the official FBI statistics for robberies involving ATMs. These numbers were likely significantly influenced by the 2020 pandemic.

How do you protect your organization and clients against ATM crime?

Across the globe, consumers and institutions have pivoted in response to the COVID-19 moment and emerging technologies. Unfortunately, criminals have pivoted as well. To combat this movement, financial institutions can engage in target hardening of ATMs to address vulnerabilities, deter criminals, and better assure customer safety. These additional security investments can include security cameras, improved lighting, and even security doors that only allow bank members to enter.

The Pinkerton Crime Index can further inform preventative decision-making, offering neighborhood-level insights on community safety. This may impact the placement of ATMs as well as help security teams determine which ATMs may demand additional security expenditures.

Pinkerton combines more than 170 years of real-world experience with cutting-edge technologies to protect our clients and their organizations.

Pinkerton. We never sleep.