Humans can live without oil. We did so for millions of years. Same goes for natural gas, coal, and other fossil-based fuels that are so central to the global economy today.

But water? That’s a much different, and critical story. In this third Water and Security post, we take a look at how water is already impacting the world’s economic stability and what risks the future of water could pose for your business. For this post, we consulted with economics professors at Colorado State University (CSU) for their insight regarding the risks water shortages can pose for businesses worldwide.

Population movement

Countries throughout the world are already starting to realize the impact water scarcity has, and will have, on their economies. “In places like the Middle East and the Sahel of Africa, ” said Sammy Zahran, CSU’s Associate Professor of Demography, “governments have limited capacity to redistribute water resources, so severe droughts can spur migration and cause intra-country conflict and, potentially, war. Reflecting the latter possibility, Egypt has recently demanded that Ethiopia stop construction of its ongoing mega-dam project on the Nile.

“In tense statements, Egypt has vowed to protect its historical rights to the river at “any cost.” The negotiations among officials of Egypt, Ethiopia and Sudan have been marked by direct confrontations and escalating tension.” Potential solutions are complex and the process remains contentious.

In Syria, while other issues are certainly contributing factors, the mass migration of millions can be partially traced back to water scarcity. The agriculture industry, both as a food and income/job source, dropped off significantly due to lack of water. That caused stress to both the economic and social systems, resulting in people leaving the country in droves, searching for a safer and more sustainable life. That in turn, put stress on the systems and economies of the countries in which the refugees attempted to settle, leading to more conflict and significant costs to governments.

Even far across the globe, the economic impact is significant. The Center for Immigration Studies estimated that it costs the United States nearly $65, 000 over five years to resettle one Syrian refugee. As populations shift, your business could find itself having to handle an influx, or outflow, of people from regions where you have operations. The costs will impact the government’s ability to deliver services, the availability of a strong labor pool and your general costs of doing business.

Effects on energy costs

Water is, of course, an energy source that is used throughout the world. Hydropower is the leading source of renewable energy throughout the world. It is also one of the most debated since the impact of damming rivers, environmentally and, as in the example above, economically, can be quite negative. Debating the pros and cons of this power source will continue. We want to focus on water’s cost on other energy sources. Coal and natural gas burning electricity plants generate steam to generate energy through turbines and are still the most used forms of energy production globally. And they use a lot of water! A single coal facility can consume one to four billion gallons of water per year.

The cost associated with extracting the water from nearby lakes and rivers, using it to cool turbines and generate steam, and then creating systems to return the water cleanly is a large part of the cost of coal energy. Increased regulations and environmental requirements regarding the quality of water output have put a financial burden on energy producing companies. If these facilities operate where there is a drought or increased water scarcity, the costs escalate, which is passed on to businesses and consumers through higher energy rates. The risk to companies, especially if you are in high-use industries like manufacturing, technology and food/agriculture production, is significant and must be factored into your long-term plans. Competitors located where water is far more abundant could realize a significant competitive price advantage.

Water and the economy in 50 years

“Over a 50 year horizon, water scarcity is a much more critical issue for the global economy than shortages in fossil fuels, ” explained Terry Iverson, Assistant Professor of Economics at CSU. “While constraints on the oil supply may start to bind within 50 years or so, natural gas and coal will remain abundant. Moreover, technological changes will likely make it possible for natural gas, coal, and renewable energy sources to substitute for oil in most if not all critical applications.”

Desalinated water, already widely relied upon in the Middle East and India, will continue to be an alternative, clean water source. However, it is quite expensive even for countries with coastal access while inland countries need to factor transportation into the process, escalating the cost further.

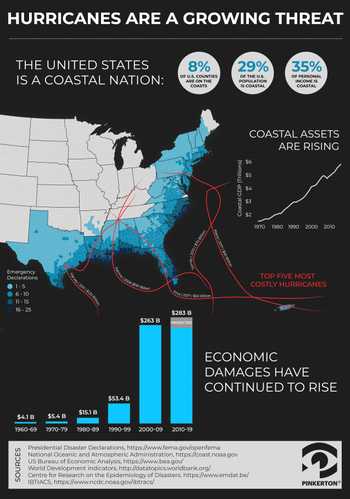

Though ocean water will become a fresh-water alternative for more nations, the oceans themselves will be a much bigger problem. Rising seas, due to global temperatures rising, will be a big problem in 50 years, possibly sooner. “Typical forecasts suggest that global sea levels will rise approximately .3 meters in the next 50 years, ” said Iverson. “This degree of sea level rise would put at risk trillions of dollars of infrastructure in the city of Miami, Florida, alone. It will also simultaneously put at-risk populations and infrastructure in dozens of major coastal cities around the world.”

“The simultaneous, global nature of these damages will put an unprecedented strain on global insurance markets and aid flows to impacted regions, ” warned Zahran. Forecasting your business’s growth economically has to take water access into account. Conflicts over water rights, escalating costs associated with water’s use for energy production and infrastructure risks rising seas present to your facilities are key elements to study for any long-range planning.