This blog is a part of our series, "Perspectives in Crime" where we explore leading academic studies that touch on crime data.

Researchers from diverse fields continuously seek statistical information that can forecast crime rates. Such efforts generate insights of societal and economic factors that contribute to criminal incentives that produce a greater number of criminal offenders. A popular predictor of crime has been the unemployment rate. Intuitively, the greater number of people out of work, the greater the number of motivated offenders. Others have focused on total economic output, wages, and consumer sentiment as economic signals that might meaningfully impact crime rates.

“Crime and Inflation in Cross-National Perspective”

In his 2014 paper, “Crime and Inflation in Cross-National Perspective” published in Crime and Justice, Richard Rosenfeld, an American criminologist at the University of Missouri- St. Louis, reevaluated the predictive efficacy of economic indicators, concluding that inflation is the most powerful economic predictor of crime. Rosenfeld states that during the 2008-09 great recession, crime rates failed to spike as anticipated, despite a wave of unemployment, suggesting that unemployment is a less reliable indicator than economists and criminologists have assumed. He suggests that low inflation rates explain the absence of a surge in crime following high unemployment. Rosenfeld’s work is particularly pertinent in the Covid economy, as nations across the globe contend with both increases in inflation and crime.

Historical research suggests a relationship between high inflation and increases in crime, but it has not been a frequent topic of contemporary research. Rosenfeld speculates that this is owed to the relative stability of prices since the 1990s, and he hazards a guess that low levels of inflation could be an important reason why crime rates have fallen in Europe and the United States since the mid-1990s.

Shadow economies and inflation-driven crime

Rosenfeld points to underground or “shadow” economies as one meaningful mechanism of crime encouraged by high inflation. The inflated cost of goods motivates consumers towards cheaper goods, a move he calls “trading down.” This trading down effect is also realized in the demand for illicit and underground goods. The higher demand for stolen goods encourages acts of burglary, theft, and robbery. Because there is no regulatory oversight or formal channels to mediate disputes, these shadow markets are often plagued with violence. The share of violent crimes encouraged by underground markets is a story well represented in the war on drugs. The diagram below illustrates the logic of how inflation increases violent crime.

The work of the historian David Hackett Fischer identified four major instances of inflation in Western history, in the 14th, 16th, 18th, and 20th centuries. In each of these periods, violent and property crime rates increased, and then fell once prices stabilized. When inflation decreased in the early 1990s, both Europe and the United States saw a corresponding decline in crime.

The Great Recession of 2008 and 2009 cued many signals that economists and criminologists have frequently assumed to be key determinants of crime. A severe decline in economic output, high unemployment, and low consumer confidence struck nations throughout the developed world. Despite this, crime rates did not rise as expected. Some work has attributed this to falling prices, citing falling crime rates during the Great Depression as a historical instance of this relationship.

Rosenfeld’s own data work on this question uses published statistics of three offenses, homicide, robbery, and burglary from 1980 to 2010 from 13 European nations and the United States. He utilizes Uniform Crime Reporting (UCR) for the United States data, and for the European nations he utilizes data from Interpol, from the European Sourcebook of Crime and Criminal Justice Statistics, and Eurostat.

The relationship between crime and inflation rates

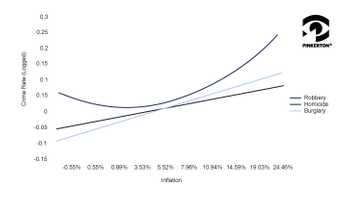

Crime shows greater volatility than inflation, but the two series exhibit a rough correspondence over the study period, particularly as both declined during the 1990s. Rosenfeld suggests the relationship between crime and inflation rates is curvilinear. Controlling for other factors and running multivariate models, Rosenfeld includes the following plot describing the projected relationship between log crime rates and inflation rates.

Rosenfeld argues that the 2008 Great Recession makes a strong case for inflation as a determinant of crime. During this period inflation fell while unemployment increased and economic growth halted. Despite poor economic conditions, crime rates declined during this period, mirroring the inflation rate. To further understand the impacts of inflation on crime, Rosenfeld suggests a longer time span would need to be analyzed, but suggests that the many shifts in prices, unemployment, growth, and crime rates offers a meaningful window into this relationship. Understanding economic indicators of crime assists in decision making in the short and long-term and helps facilitate allocation of guardianship resources. As societies, economies, and firms respond to shifts brought on by Covid, the more tools available for understanding the present and anticipating the future can enable decision-making confidence.

Sources:

Fischer, David Hackett. 1996. The Great Wave: Price Revolutions and the Rhythm of History. New York: Oxford University Press.

Rosenfeld, Richard. “Crime and Inflation in Cross-National Perspective.” Crime and Justice 43, no. 1 (2014): 341–66.