Reading Time: 5 minutes

Key Takeaways

- Complex Trade Networks: Global supply chains face risks from natural disasters, geopolitical events, and policy changes impacting trade stability and costs.

- Supply Chain Shocks: Firms face eight major shock types, including productivity, natural disasters, and commodity price fluctuations, affecting global trade dynamics.

- Economic Impact Channels: Shocks impact economies via increased production costs, restricted supply flow, labor market changes, and altered consumer spending.

- Regional Trade Dynamics: East Asia and Europe dominate global imports and exports, with significant intra-regional trade contributing to economic concentration risks.

- Adaptation Strategies: Diversification, dual sourcing, and agile supply chain strategies are critical but may increase complexity, requiring careful planning to enhance resilience.

Supply chains are integral to competitive production economies. Sixty percent of global trade consists of intermediary products, goods, and services that contribute to final products sold to consumers.

While a crucial facet of international development, supply chains create new dimensions of risk. They face shocks from climate, logistics, policy, and geopolitical circumstances.

A Brookings Institution meta-analysis identified eight supply chain shock types that firms face and can prove to be inflationary levers. These are:

- Global Supply Chain Disruption

- Productivity Shock

- Pandemic Shock

- Commodity Price Shock

- Natural Disaster Shock

- Labor Supply Shock

- Critical Input Shock

- Import Price Shock

Global disruptions can affect many companies beyond the initial area and create vulnerabilities and bottlenecks in generally stable production networks. These shocks can come from systemic issues, pricing or policy changes in specific countries, or unforeseen events like natural disasters and pandemics.

The Brookings Institution identified six primary channels through which shocks produce economic impact:

Production Cost Increases: Higher production costs due to reduced productivity and increased input prices of materials. Supply Chain Restrictions: Restricted flow of intermediate goods creates bottlenecks and economic stress. Network Strain: Shocks in production networks can strain economic systems. Labor Market Changes: Availability and cost of labor can impact production and profits. Consumer Spending Changes: Shifts in consumer behavior, like stockpiling, substitution, pr precautionary changes that can affect multiple sectors. Price Competition: Some firms can better absorb shocks due to size or alternate inputs and adjust their pricing, affecting competition.

Supply Chain Planning for Competitive Advantage

Recent OECD reporting has emphasized that agility, adaptability, and alignment are key to resilient supply chains. It is impossible to eliminate these risks, but pragmatic planning offers organizations opportunity to mitigate them and rise above the competition that is unprepared to face these varying dimensions of risk.

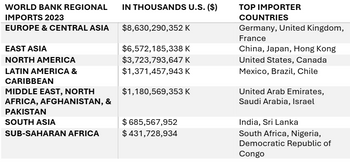

The World Bank publishes statistics on country and region-level imports and exports. Their most recent available data shows money spent on imports on a regional level.

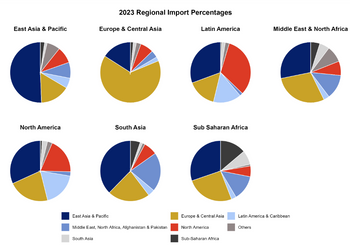

Additionally, World Bank data allows us to understand the extent of trade occurring within a specific region compared to the trade that involves moving goods between different regions worldwide.

The above charts show that the East Asia & Pacific region is a significant source of imports across the world. With the exception of Europe & Central Asia, more than a quarter of imports in every region originate from East Asia. A significant majority (65.28%) of Europe and Central Asia’s imports originate from within the region. Latin America and the Caribbean are significant sources of within-region imports and imports in North America.

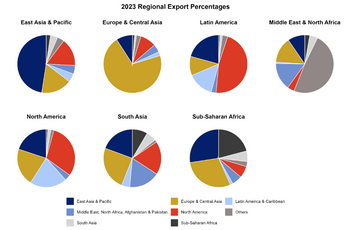

The World Bank's export data reveals that Europe, Central Asia, and East Asia significantly outperform other regions in terms of the volume of trade exports.

The charts highlight that Europe and Central Asia prioritize within-region trade, with 70.61% of their exports staying local. This is notably different compared to the balanced export approach seen in South Asia and North America. East Asia, while having more diverse export revenues, still directs almost half of its exports within the region. The charts also emphasize the importance of Latin American trading partnerships to North America, making up nearly half of North America's total exports.

OECD models found that economies with strong vertical links to major foreign economies tend to be more exposed to international supply chain shocks. Canada, France, Germany, and the United Kingdom are the most exposed among all OECD countries considered.

But supply chains in countries that choose relocalization are not more resilient to shocks. In fact, according to OECD models, relocalization destabilizes GDP.

The OECD found that about 30% of exported products are subject to high levels of concentration in few trading partners. Import concentration is on the rise, with many sourcing products from fewer suppliers than is globally possible. These concentrations of trade emphasize vulnerabilities to potential supply chain shocks, when transit may be strained or goods may be subject to new economic strain, driving prices.

Dual sourcing, diversification, and reshoring can increase the complexity of supply chains and are not a guaranteed way of improving resilience. Regardless of why firms adopt resiliency strategies, they must prepare for domestic risks as well as foreign risks. Supply-side disruptions, including price surges and shortages of critical components, drive inflation in ways that defy demand-focused models and policy responses.

Implementing strategies like dual sourcing, diversification, and reshoring may complicate supply chains and don’t necessarily guarantee increased resilience. Companies must be ready to handle both domestic and international risks, regardless of their reasons for adopting these resilience strategies. Supply-side disruptions—such as price spikes and shortages of essential components—can fuel inflation in ways that demand-focused models and policies may not address effectively.

Navigate Global Supply Chain Risks with Pinkerton

Transform your supply chain management by partnering with Pinkerton to mitigate risks and enhance operational resilience. We offer unrivaled expertise to help your organization navigate these supply chain complexities, especially for importers and exporters, transportation companies, shippers, freight forwarders, and emerging global logistics firms. With Pinkerton by your side, you can face any challenge with confidence, ensuring your supply chain is not just surviving, but thriving. Reach out to us today.

SOURCES

Edelberg, W. (2025, November 18). A taxonomy of supply shocks and their effects on inflation. Brookings. https://www.brookings.edu/articles/a-taxonomy-of-supply-shocks-and-their-effects-on-inflation/ \

OECD (2025), OECD Supply Chain Resilience Review: Navigating Risks, OECD Publishing, Paris, https://doi.org/10.1787/94e3a8ea-en.

World Bank. (n.d.). Regional Trade Analysis. WITS. https://wits.worldbank.org/visualization/regional-trade-analysis-visualization.html